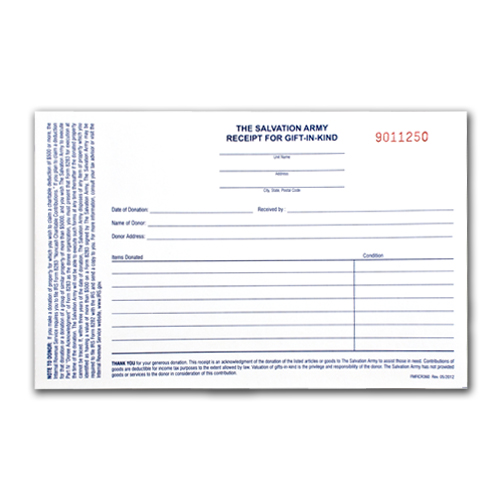

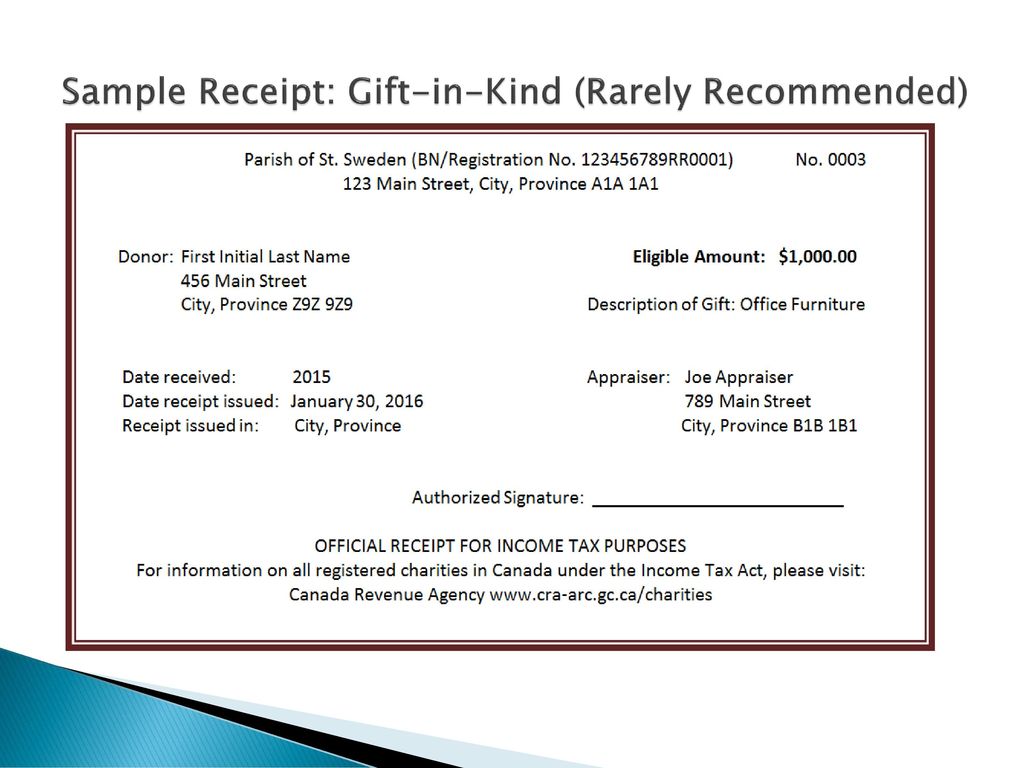

gift in kind receipt

K-4 Responsible for Policy. When it comes to in-kind donations.

A donor gives a charity a house valued at 100000.

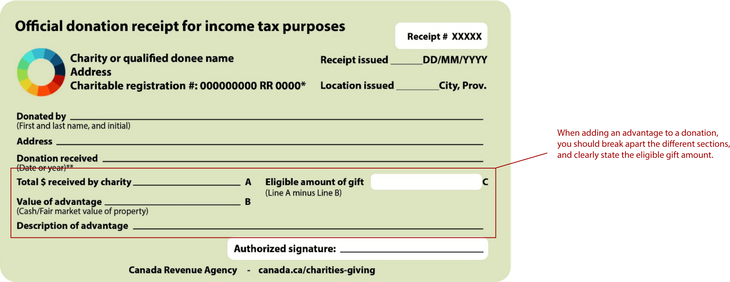

. The following calculations are used to determine the eligible amount of the gift for receipting purposes. After a Gift In Kind non cash donation is received directly by UW Madison from a donor the campus department is responsible for issuing a GIK donor. In-kind donations for nonprofits can be made by individuals corporations and businesses.

The donations must be entered with exactly Gift in Kind in the Cheque Paid By field and must have a description of the gift in the Description field. This is a deeply conflicted bike noted contributing editor Marc Cook. Therefore the advantage must be 50 or less.

According to GAAP guidelines the IRS requires tax receipts be provided for gifts of 250 or more. Similar comments appeared in the VFRs logbook. Donors who give gifts in kind would like to know the benefits of a receipt for a gift in kind.

They are receipted separately using the. 10 of 500 is 50. While an acknowledgement letter may act as an in-kind donation tax receipt it is a donors responsibility to make sure that they keep accurate records for tax purposes.

The amount of the advantage 20000 must be. In-Kind Gift Receipt Policy Number. This is a deeply conflicted bike noted contributing editor Marc Cook.

Your gifts allow us to provide needed resources and support for other Christian. They explained that due. Lincoln NE 68508 P.

Yes you are the recipient of a very generous In-Kind gift. Some examples of in. Yes indeed in effect.

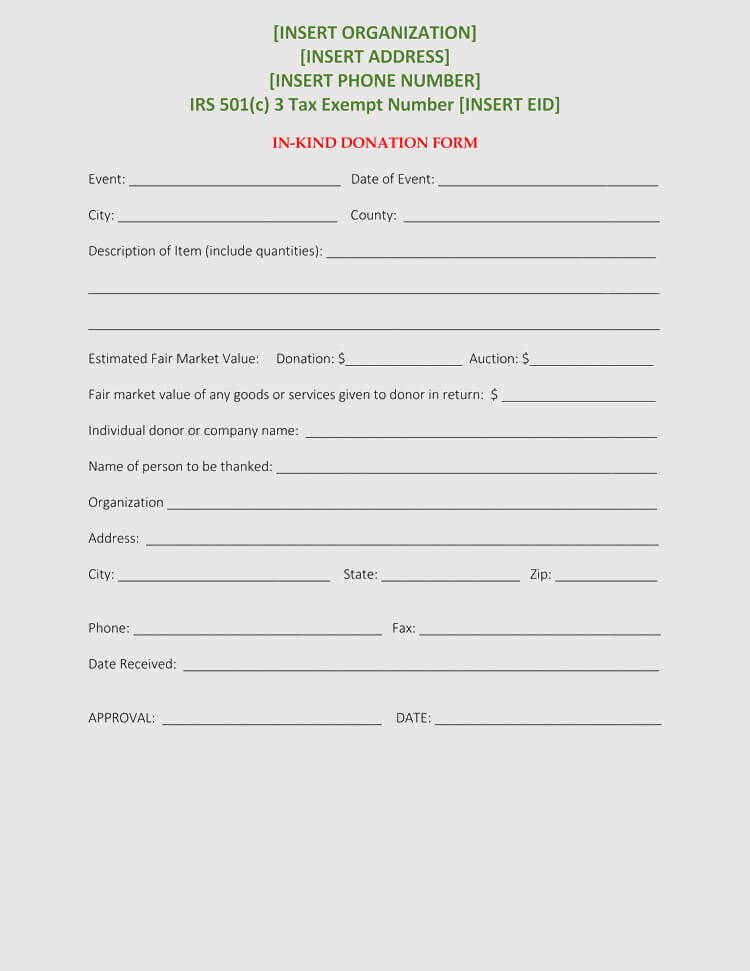

Please note according to IRS regulations establishing a dollar value on donated items is the exclusive responsibility. Lincoln NE 68510. The value of the in-kind donation in question.

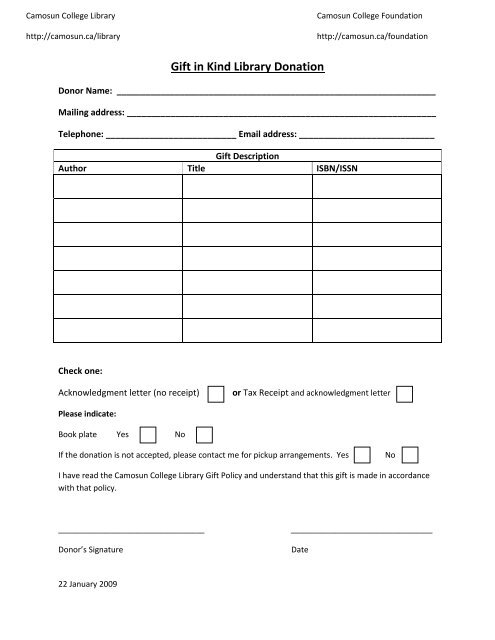

4024751303 HOMELESS PREVENTION CENTER. Fall 2012 Date of most recent revision if applicable. In Kind Gift Receipt In Kind refers to donations of goods instead of cash.

In Kind Gift Receipt In Kind refers to donations of goods instead of cash. May 2010 Most recent review. In the case of a donor having an amount taken directly from their paycheck they can use a W-2 wage and tax statement or other employer-provided documents that detail the.

The charity gives the donor 20000 in return. Sample 4 Non-cash gift with advantage. Print one duplicate or corrected receipt for the currently selected donor for the receipt number of the currently selected donation which must be listed.

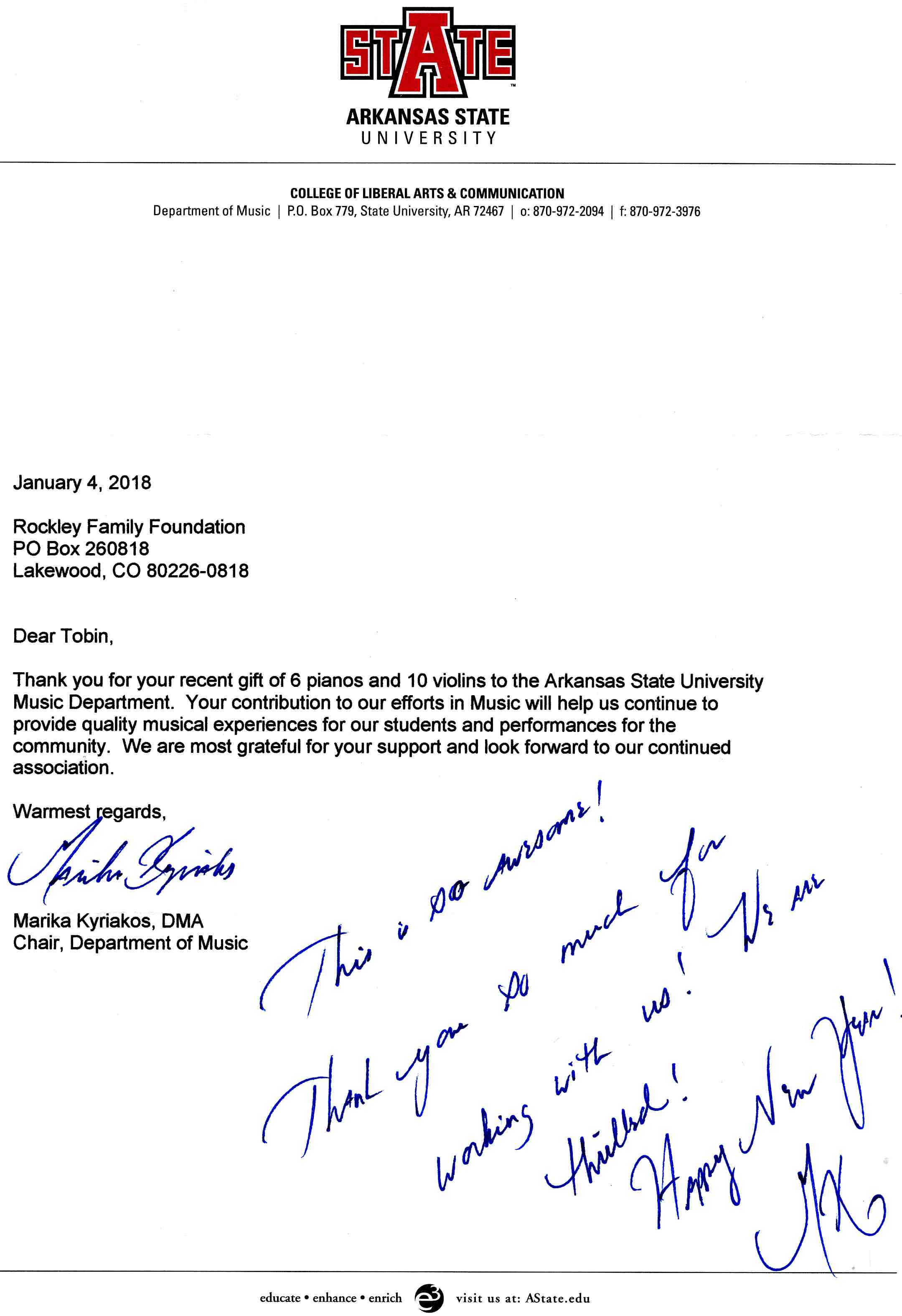

Sample gift in kind receipt letter. Gift In Kind Acknowledgement Letter. Whether you have receipts to the penny or if you know from other valid references regarding the expense paid for by the corporation.

Do they receive the same deduction as for a receipt for a cash donation. In-kind donations are non-cash gifts made to nonprofit organizations. Do they receive the same.

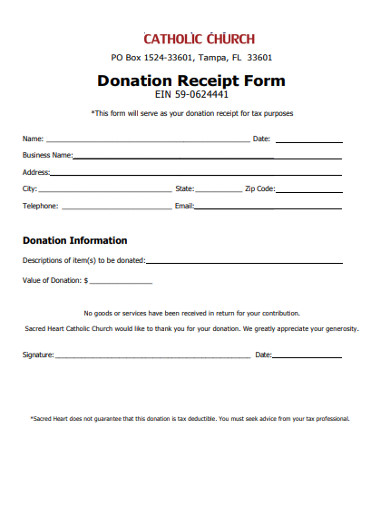

Church Donation Receipt Form Templates Pdffiller

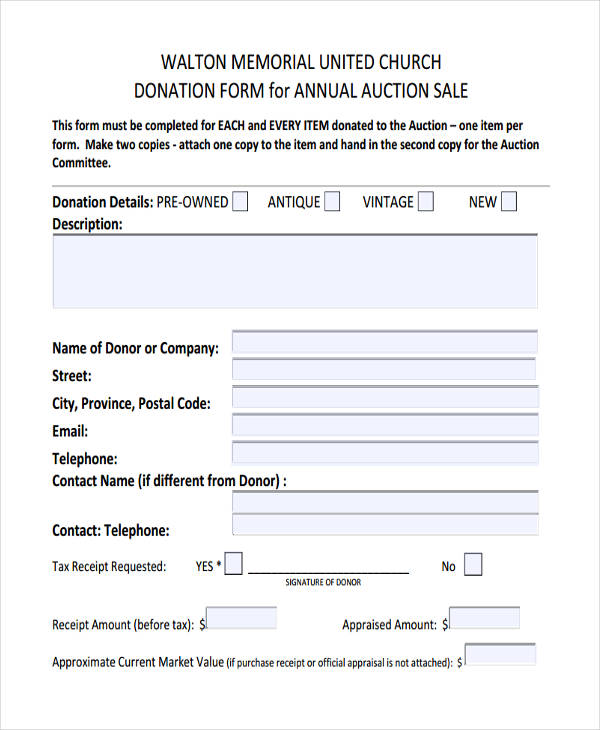

24 Printable Church Donation Receipt Template Forms Fillable Samples In Pdf Word To Download Pdffiller

Free 12 Donation Receipt Forms In Pdf Ms Word Excel

Free Donation Receipt Templates Samples Word Pdf Eforms

45 Free Donation Receipt Templates 501c3 Non Profit Charity

Get Our Image Of Gift In Kind Donation Receipt Template Donation Letter Template Receipt Template Donation Letter

Treasurers Training Day Ppt Download

Donation Gift Receipt Quid Pro Quo Small Business Free Forms

In Kind Donation Receipt Template Printable Pdf Word

40 Donation Receipt Templates Letters Goodwill Non Profit

Gift In Kind Library Donation Camosun College

How To Create A 501 C 3 Tax Compliant Donation Receipt Donorbox

Instrument Donation Acknowledgements Rockley Family Foundation

Explore Our Example Of Non Profit Contribution Receipt Template Receipt Template Non Profit Donations Donation Letter Template

Nonprofit Donation Receipts Everything You Need To Know